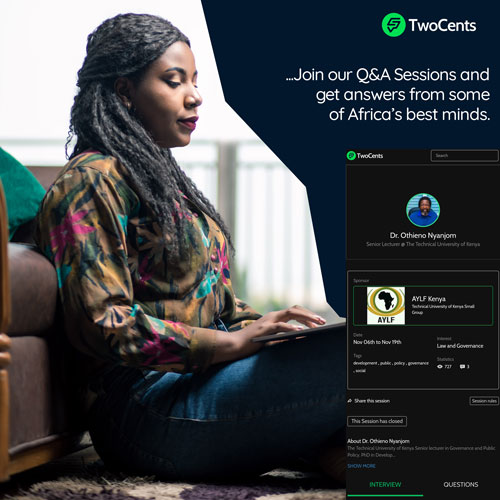

This Session has closed

http://paulgraham.com/start.html

https://startupclass.samaltman.com

Hello Yele, I want to apologize from the onset for my numerous questions because i aspire to become a venture capitalist.

Please I would be most grateful if answers are relate-able to the way of life in Nigeria seeing we are in Nigeria.

1. what is the duration of your preferred exit/ROI when you invest?

2. What are the top 5 criteria you consider when investing?

3. Since your journey investing, what has been your biggest mistake and lesson learned?

4. What are top sectors you have invested in?

5. As a startup, what should i think of or put in place before contacting an angel investor or VC?

6. I understand the risk of investing in start ups, how do you react when a startup you invested in does not produce good returns or fails?

7. As an aspiring venture capitalist, what is are the steps in being one and your general advice? Thank you.

What is the duration of your preferred exit/ROI when you invest?

- 7-10 years (although we might sell a % shares earlier to lock profits in secondary markets)

What are the top 5 criteria you consider when investing?

* Large Market Size

* High Quality of team

* Really painful Problem / real market need

* Distribution/Acquisition Channel

* Simple business model

Since your journey investing, what has been your biggest mistake and lesson learned?

* Not sure I''ve made a big mistake yet, but we''re still early and mistakes are part of the journey

* My biggest lesson is the quality of the team matters most, so invest in quality founders that I can see myself working for.

What are top sectors you have invested in?

* Fintech

* Crypto

* Education

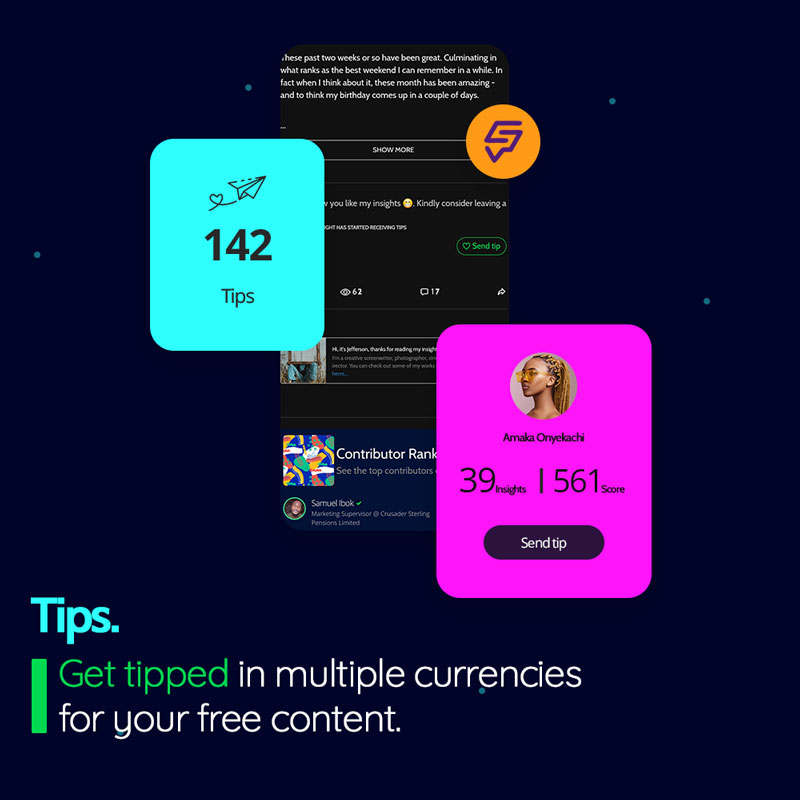

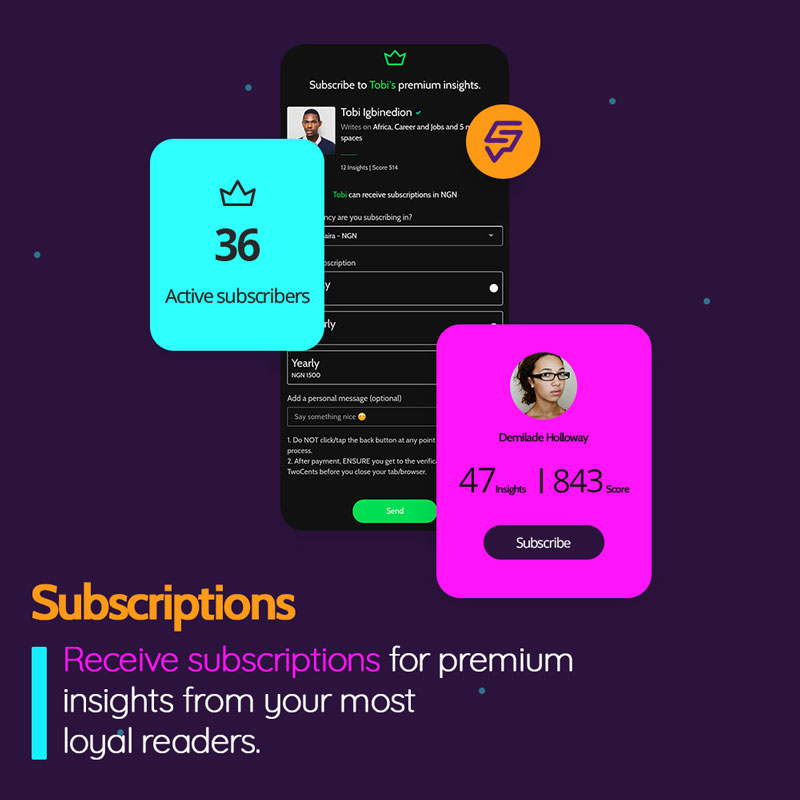

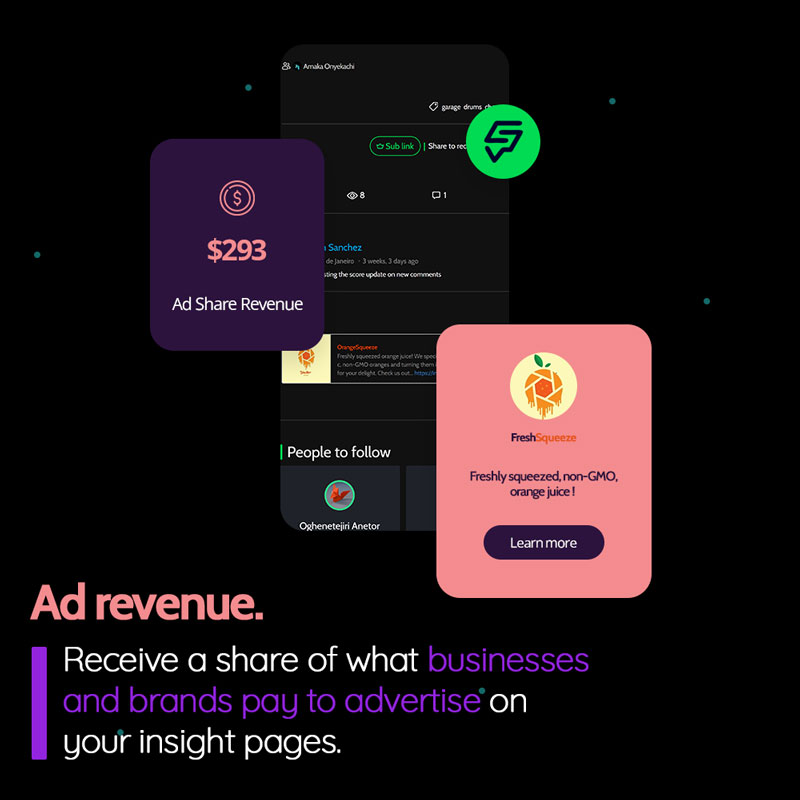

* Just done a deal in social commerce (TwoCents Exclusive)

As a startup, what should i think of or put in place before contacting an angel investor or VC?

*Have a product, show you can build something and have some users

I understand the risk of investing in start ups, how do you react when a startup you invested in does not produce good returns or fails?

* I expect at least 70-80% of my investments to fail

As an aspiring venture capitalist, what is are the steps in being one and your general advice?

* Start a startup and learn from the experience

* Try writing an investment thesis/memo on a company that hasn''t raised money and why you would invest in them, check out opentraction.com for sample investment memos

Hi Yele,

First is, would you say a lot of early stage Nigerian startups are getting over-capitalized which has inevitably lead to crazy, inflated valuations that never get justified? and if yes, what do you think is the best way (for VCs and Angels) to go about valuations for early stage (pre Series A) startups.

Second is, after investing in several startups across Nigeria and Africa, what are 2 major insights you have gleaned so far as regards maturity of verticals, quality of team and product-market fit.

Lastly, a lot has been said in the ecosystem about B2B versus B2C as per maturity, monetization, growth potential etc - what's your take on this?

Thanks.

At the early stage, valuation is more an art than a science, first both sides have to want to do the deal, then is there an intersection between my maximum and their own minimum valuation, if there is then we do a deal, otherwise I try to connect them to later stage investors or we revisit when the company has made enough progress to get the valuation they want.

Another contrarian viewpoint, I don't think many companies that get started are venture backable, they may make good profitable software businesses but only 2-3% of software or tech-enabled businesses are venture backable. It's a function of how big the company can be from a revenue standpoint (at a minimum $25m/yr), which is a function of how big the market is ($100m+/yr and growing) and fast you can capture the market i.e. an adequate distribution strategy for the product offering.

For now, I am biased towards B2B & B2B2C offerings - consumer African startups have struggled to scale cost-effectively so we are looking for businesses that can leverage commercial / distribution partnerships to scale.

1. How does a business know that his business needs funding (above the desire to just have money to throw around)

2. If I want to enjoy angel investment as a business owner, what is required of me to do such that I don''t get turned down or seen as unserious?

Thank you.

Most new businesses need money, but it''s a function of if the business will/can get the capital it needs.

Answered a similar question earlier on how to go about getting investment as a company/startup :)

702

702

4

4

Share this session

Share this session

Boston, United States

Boston, United States

Comments